![]() When the first smartphones arrived on the scene, one of the first application ideas was to use them as digital wallets. Unlike prior digital wallets that required multiple transactional parties and banks to participate, Apple has made the steps to acquire and use their digital credit card an easy, painless, and dare I say, fun process. The Apple Card has arrived. Let's go over how to apply for an Apple Card, which APR you can expect, how to get a physical Apple credit card, where and how to use the Apple Card, and how to get cash back with Daily Cash.

When the first smartphones arrived on the scene, one of the first application ideas was to use them as digital wallets. Unlike prior digital wallets that required multiple transactional parties and banks to participate, Apple has made the steps to acquire and use their digital credit card an easy, painless, and dare I say, fun process. The Apple Card has arrived. Let's go over how to apply for an Apple Card, which APR you can expect, how to get a physical Apple credit card, where and how to use the Apple Card, and how to get cash back with Daily Cash.

Related: Why the Wallet App Makes the Apple Card Worth Getting

The Apple Credit Card Application Process

Signing up for the Apple Card is as easy as launching the Wallet app on your iPhone. Upon doing so, you can opt to add the Apple Card to your Wallet. You’ll be prompted to enter your name, address, birthday, income, and last four digits of your Social Security number. If your income and credit score meet the minimum threshold, Apple will determine your credit limit and Annual Percentage Rate (APR), which can range from 12.99 to 23.99 percent.

Unlike some other credit card companies, Apple doesn’t tack on penalties, annual subscription, or transaction fees. If you agree to the terms, selecting the “Accept Apple Card” button will issue your card and give you the choice to have a physical credit card. While some digital natives may prefer not to accept this option, it’s one of the primary reasons this service garnered so much hype.

Hands On with the Physical Apple Card

It took nearly two weeks for my card to arrive in the mail, and the anticipation of receiving and inspecting it was similar to waiting for other Apple products. The presentation of the box and the meticulously machined, stamped slice of titanium is unlike any other credit card I have received. It has a weighty feel and makes a satisfying steely sound when placed on a table; just the kind of sound power lunch executives love to hear.

As with other Apple hardware, the card screams to be encased in a protective shell to preserve its pristine, brushed metal perfection. Indeed, Apple has posted warnings on its website for OCD types like me, reminding us to keep the card from rubbing against denim and leather, or even coming in contact with other credit cards for fear of creating scratches or blemishes. Consequently, Apple Card users who prefer to keep their cards in a factory-stamped, fresh state might want to keep it wrapped in the sleeve it arrived in or perhaps tucked away in a locked drawer somewhere.

Of course, iPhone case vendors like Dbrand have already recognized this as a market opportunity and offer a collection of Apple Card skins and wraps. I opted for a less expensive solution and used a plastic trading card sleeve to protect my card. That way, I could still carry it in my wallet to show it off to my friends and coworkers, while protecting it from coming into contact with the real world.

All this effort to keep the Apple Card in its pristine state seems excessive, and it is. It’s also unnecessary, since every brick and mortar retailer I shop at accepts Apple Pay.

Putting the Apple Card to Use

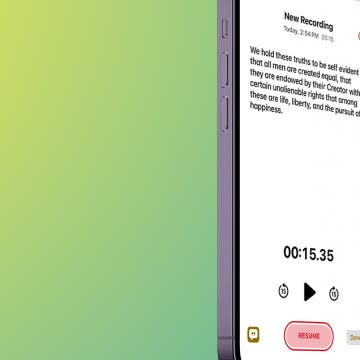

Once your Apple Card has been issued in the Wallet app, Apple suggests using it as your default card. Then, whenever you check out at a business that supports Apple Pay, just bring your iPhone close to the credit card reader. Your iPhone will display a screen informing you of the amount to be charged to your Apple Card. If you accept, acknowledge via Face ID or Touch ID, depending on your iPhone model, and you’re done.

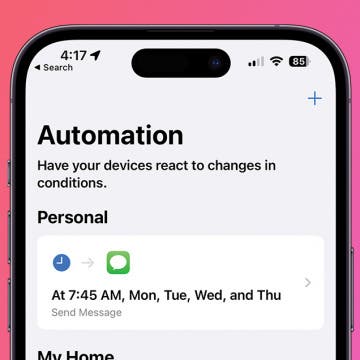

Unlike other credit cards that you can use with the Wallet app, the Apple Card offers real-time tracking of expenses by category, as well as reminders when your payments are due. To set up payments, provide your bank account’s routing and account numbers. Apple can then automatically deduct payments. You can choose to pay off the balance early, or have Apple remind you when monthly payments are due.

Another benefit of using the Apple Card is its immediate cash back bonus option. To enable this feature, set up Apple Cash to start earning up to 3 percent Daily Cash on your purchases. This cash back is deposited into your Apple account and can be used like regular money.

While some competing credit cards offer cash back options, they are frequently disconnected from the immediate purchases and often include hurdles that prevent reward redemption. Apple eliminates these barriers by depositing your cash back rewards daily.

I received five dollars in Daily Cash rewards using the Apple Card for groceries, and could instantly spend that cash on Apple hardware and apps, message another Apple Cash user the money, or spend it anywhere Apple Pay is accepted. I instead opted to horde my Daily Cash to be used at a later date.

Is It Worth the Effort to Acquire an Apple Card?

It was for me. Even though I already have credit cards linked in the Wallet app, the real-time integration of the Apple Card makes my purchases more transparent. Having my transaction history in the same place as my card data also means I don’t have to bounce out and open my bank app to find out my balance and recent history.

It’s even nicer to receive the faster gratification of Daily Cash, and I’ve somewhat gamified the experience, as in, “How much cash back reward can I accumulate before spending it on apps or goods?” And yes, the physical Apple Card is a cool badge of geekhood, but unless you frequent small establishments and eateries that remain in the financial stone age, requiring a physical card for transactions, it will rarely leave your wallet.

Since receiving the card, I have only unsheathed it from its protective card sleeve twice. This was not because I needed to use it for a purchase, but rather, to show it off to friends curious about how it looked and felt. Both conversations ended with the question, “How do I get one of these?”